Karen Myers shares estate planning advice for indie authors and micropublishers

Although most indie authors may plan never to retire from writing, it's indisputable that we will all at some point die. We should therefore include the intellectual property we create through our writing alongside our other assets in our estate planning. The more successful our indie author business, the more it's worth securing for our chosen heirs. And if, as a growing number of indies are doing, we manage publishing projects for other authors, we need to make sure their interests are covered as well as our own. Indie author and micro-publisher Karen Myers shares her recommendations to help you with estate planning for your own self-publishing business.

Let's talk about estate planning for independent author-publishers. Not a fun topic, I know, but there's no point shoving our heads into the sand in the enthusiasm of the young indie-author revolution and pretending that we're going to live forever.

Business Succession Planning

All businesses face succession issues — who will take over for key managers and employees. In larger firms, this is just a normal plan, part of the annual review of the business's readiness to handle change.

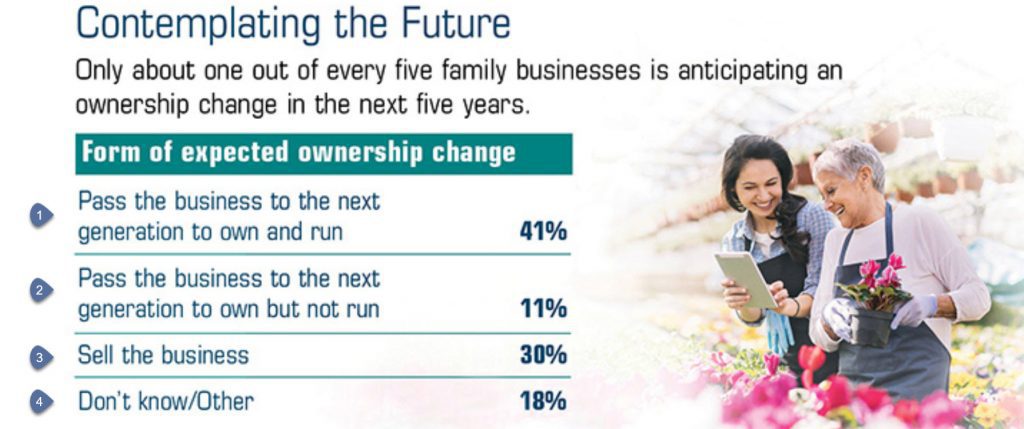

Family businesses have additional challenges — what will be the role of the family members in the business once the founder dies or retires? Will they run the business, or will they just own it and let others run it? Will they sell it, and how?

A business is an engine for making money. Without the right people in place to make it work, or someone to sell it to, it falls apart.

We indie authors are typically one-man businesses. We don't think in terms of key employees, since we haven't got any, but we are ourselves the key employee, and we need to make plans for what will happen when we are no longer able to run our business. And if we've managed to grow large enough to have actual employees, we have the same issues as any other small business. We need a business succession plan.

What Are the Choices in Business Succession Planning?

Let's look at the typical situation for family businesses. Most of us can't expect our heirs to run the business. As one-man operations, we haven't trained them for it, and they are probably not interested or qualified to do it. So that knocks out steps 1 (pass the business to the next generation to own and run) and 2 (pass the business to the net generation to own but not run) above.

What does that leave? I suspect that almost all of us fall into step 4, the “Don't know” step, instead of trying to find ways to embrace step 3 – to sell the business.

And let's not forget that many of us are not young — many writers are already retired, and this is a more urgent need than we like to contemplate.

What If We Do Nothing About Estate Planning?

Let's say we actually manage to write down, in an estate document, all the business accounts and passwords for all the elements of our indie-author/publisher business.

Our poor heir has a sheet of paper, and no idea what to do. Proceeds for our sales will still go into our bank account, for a while, but who will pay royalties to any other author we may be publishing? Who will monitor advertising daily spends?

Because we don't have employees like a larger business, there are not enough automated systems in place for the business to just run on autopilot, and there's no one to turn to.

If we are very fortunate, there's an understudy within the family that's been introduced into some or all of the business processes, but I doubt that very many of us have that option.

So, the business at best will simply wind down, and at worst there will be continuing spending to be tracked or shut down, and contractual obligations to other authors.

Speaking of contracts, if we contract with another author to be their publisher, we must have some sort of succession planning in place, or we will fail in or contractual obligations.

What Can We Do About Estate Planning?

We can make plans and arrangements. Most small businesses in this situation (perhaps you built a small hardware store) would sell the business if there's no one available to run it as is. We should do the same.

As a micro-publisher, I could take on the catalog of business of another micro-publisher — their own titles, and their author contracts. What I can't do is buy it outright — most of us don't have capital for that sort of thing, even if we can agree on how to value it.

But there's no reason I couldn't pay the seller or the seller's heirs a percentage of the earnings of that catalog for some defined period of time. That fits with the cash-flow of the natural indie-author/publisher business and aligns my interests with those of the seller's heirs.

On my side, I would make a similar arrangement with another micro-publisher for my own succession planning.

Rolling Up Micro-publisher Businesses

As the indie-author/publisher business explosion matures, I believe this sort of business roll-up will become the natural way to address business succession planning.

Authors and micro-publishers will seek out potential partners and make tentative or firm plans with them, recorded and triggered in their estate plans or executed when the seller retires from the business. Acquiring micro-publishers will evolve practices for managing and paying royalties on such acquisitions, just as they evolve practices for managing and paying royalties for their published authors.

In the absence of this, heirs would need to seek out such buyers on their own, or watch the business decay in their hands.

I'd love to speak with other micro-publishers about their plans in this area as we all evolve best practices for that contingency that none of us can dodge forever.

This post also appears on Karen Myers' blog here, where you can find more advice from her about running an author business, gleaned from her own experience.

OVER TO YOU If you've already made plans for your author business after your death, do you have other advice to add to Karen's? We'd love to hear about them.

#Indieauthors - we may never plan to retire, but we all need to plan for what will happen to our #writing and our rights after we die. Karen Myers of @HollowlandsBook offers advice. Share on X

Interesting ideas about giving intellectual property to a micro-publisher. What isn’t covered is how to make sure your heirs (whether that is family, friends, or a nonprofit) benefit from that.

In my will, I’ve assigned a literary executor separate from the primary executor of my estate. The reason for that is that my executor really knows very little about intellectual property and how to exploit it. My children also don’t know and have little interest in learning–they have their own lives and children and lots of other things on their plate right now. By having a person I trust to be the literary executor, she receives a percentage of the profits for her work and the remainder is equally distributed to the children.

A layman’s book I found very helpful for starting this plan is M. L. Buchmann’s Estate Planning for Authors. It begins with the concept of your “final letter” to your family which outlines everything you need them to know, including your inventory, current distribution, partners, access, and the appointment of a literary executor.

Interesting. Where do we get the book M. L. Buchmann’s Estate Planning for Authors?

Amazon Kindle or paperback.

Maggie, I’m so pleased you saw fit to reply as I learned more from your reply than I did in the whole of the article.

Thank you!