This is the third in a series of posts about the campaign known to self-publishing authors as #AudibleGate. ALLi would like to extend thanks to Colleen Cross for this post and for her work with the Fair Deal for Rights Holders and Narrators pressure group. Colleen's first post provided useful background information that sets the context for this more detailed post about one particular earnings category: Audible subscription earnings. If you haven’t already, please sign the #Audiblegate petition here to be kept updated as the campaign develops. Now over to Colleen.

Colleen Cross

This post is about the earnings rights holders receive when an Audible member exchanges a credit for an audiobook. It’s the “AL” category on ACX earnings statements. AL royalties have some complicated math. I promise to keep things simple with high-level explanations.

Audible Numbers are “ALAF” (pun intended)

It’s important for an audiobook publisher to read the Audible Listener Allocation Factor (ALAF) clause in the ACX/Audible agreements (reproduced below). You don’t have to understand it yet but just read it, please. I will make my point in a minute.

From the “Audiobook License and Distribution Agreement:

“Membership Net Sales Receipts” means, for each Unit, the monetary amount obtained by multiplying the AudibleListener Allocation Factor (as defined below) by Audible's a la carte price for the Unit at the time the AudibleListener Allocation Factor is calculated.

The “AudibleListener Allocation Factor” means the total of all membership sales receipts derived from sales of all content sold by Audible in the applicable accounting period, less any cash incentives, promotional discounts, device subsidies or rebates, sales or use taxes, excise taxes, value-added taxes, duties and returns, divided by the total a la carte value (as determined by Audible's applicable a la carte price for the Audiobook at the time the AudibleListener Allocation Factor is calculated) of the membership sales of all content sold by Audible in the applicable accounting period.

The agreement generally says that the royalty per audiobook is a pro-rated share of an ever-changing pool based on the many, many variables that compute the “Audible Listener Allocation Factor” or ALAF. There are oh, so many!

Since I’m an accountant, I like to dig into complicated equations and formulas to see how things really work. I tried over and over to reverse-engineer and replicate the numbers on my earnings statements. That didn’t work because ACX/Audible doesn’t give us much information. Next, I tried to break things out with some key assumptions about the earnings formula in the contract but there were too many variables to even get past step one. In summary, I was missing information for most of the steps in the calculation.

Is that by design?

In retrospect I feel kind of stupid, signing a contract where the other party determines calculations based on hidden numbers that I can’t possibly verify. I guess I was momentarily blindsided by those dazzling “royalties” of 25% and 40% promised by ACX/Audible. This is the last time I call them royalties, because ACX/Audible isn’t our publisher and the agreements we signed were simply distribution agreements. (ALLi makes the point in its Self-Publishing Glossary that these are commissions, not royalties). From now on, in this post, I shall refer to them simply as “earnings”.

What Amazon retains–60% – 75% of retail cost, depending on whether the publisher is exclusive or non-exclusive–is a service fee for providing the platform.

The Math isn’t Complicated After All

As you'll see below, these mysterious Audible Listener (AL) and ALAF calculations won’t remain a mystery for long. The biggest puzzle of all is why, given the complexity of the calculation outlined in the contract, earnings per audiobook in the AL category (the one where the member redeems a credit for an audiobook) never varies.

Month in and month out, we always get the same earnings amount. For a $19.95 audiobook, we earn a $4.15 royalty for an exclusive book, and $2.59 for non-exclusive. The constancy of these numbers has always bothered me. Why do the numbers never change, despite all the variables mentioned in the ACX/Audible agreements?

Audible memberships are always fluctuating, as are the total number of audiobooks sold on Audible. The mix of Audible’s a la carte prices also fluctuate month to month. All of these are inputs into the calculation and there are other variables too, but you get the picture. The inputs to this “pool” calculation go up and down all the time, so why is the output for a $19.95 audiobook always constant at $4.15? The “pool” of money from the ALAF calculation constantly fluctuates yet our royalty is not.

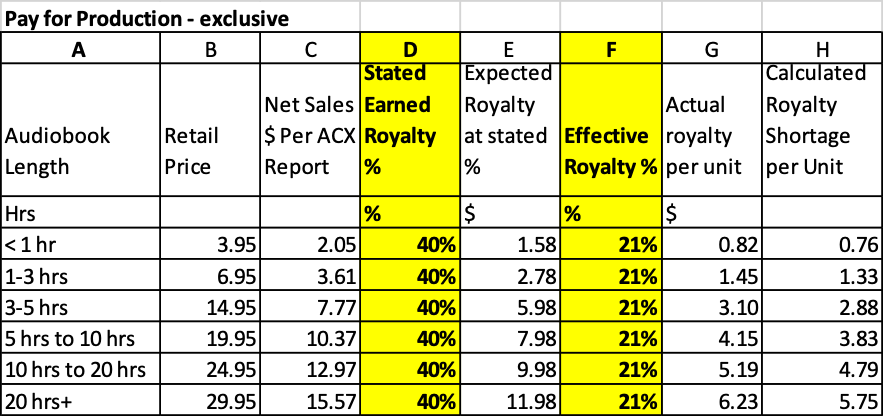

Here is the Pay for Production–exclusive earnings table from my previous post, showing the $4.15 we earn for a title priced at $19.95, along with per unit earnings for all the other price points. Compare your own earnings reports to this table at each retail price point:

I like to break apart formulas and equations to get at the nuts and bolts of a calculation. It’s how I learn and understand things. My earnings never quite amounted to what I had expected, but the whole ACX returns fiasco really got me questioning everything. Why were the payments so much lower than I expected? Did I miss something in my assumptions?

I spent weeks poring over years and years of my earnings reports, and earnings reports from other authors who kindly agreed to share with me. The result was always the same. The calculations outlined in the contract couldn’t possibly produce the numbers I saw on my ACX/Audible earnings reports.

Most or all ACX-produced audiobooks on Audible are regularly priced at $19.95 if the runtime is between 5-10 hours. They pay higher royalties for longer audiobooks, but for my books and those of other authors with audiobooks of the same running time, it was always the exact same constant payment per unit sold, month after month, year after year. The payment never fluctuated as the number of memberships, audiobooks, or anything else fluctuated on Audible. In other words, my earnings weren’t being calculated the way the ACX agreement clause above prescribed that they should be.

In fact, the rate has never varied since my first audiobook was published in 2017.

Note that this $4.15 amount is for audiobooks in the US Audible store. You can apply the same logic to the other Audible marketplaces, but know that the amounts converted into USD on your earnings reports can differ due to additional things like exchange rates, taxes, etc. The methodology is the same though. These constant amounts only make sense if Audible adds zero new members, zero new audiobooks, and has no price changes in a month.

We know that is not the case. Audible has bragged that it adds 200 audiobooks per day to its site, and other claims indicate it is doing very, very well. So how is it that we don’t see our numbers change? How is it that we authors aren’t sharing in this success? How is it even possible to get the same $4.15, every single month?

The answer is that it is not possible.

Red Flags

Remember that Ponzi scheme guy from 2008, Bernie Madoff? I wrote about him in one of my books, but the gist of the story is that is that his investments always returned exactly 12%. No more, no less. Year after year, like clockwork. We know that’s not possible because stock markets fluctuate. Well, so do all the fast-moving Audible memberships, audiobooks, and prices in the Audible store.

After months of investigation, I’m now certain that this $4.15 isn’t the result of any sort of calculation. If it was, it would be increasing and decreasing every single month. It’s not, and the calculation is just as predictable as dependable as one of Bernie’s investment statements.

Why is that? I don’t know, but my accountant’s sixth sense is telling me that something isn’t quite right.

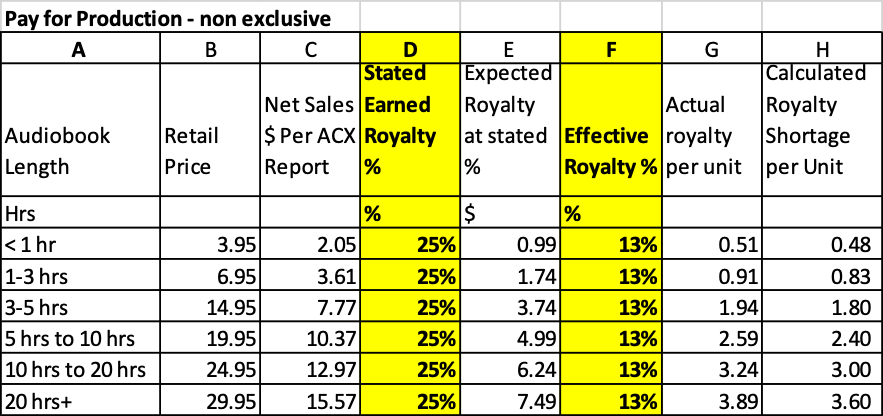

Where, exactly, did this mysterious $4.15 come from? Audible provides us with very little information beyond Net Sales, so there’s not much to go on. As I pointed out in my earlier blog post, instead of the stated 40% or 25% royalty, we only get 21% and 13%.

A Method in the Madness

After no success in figuring out how the $4.15 was calculated, I went straight to the source: ACX/Audible itself. Here is an excerpt of my latest email exchange with ACX/Audible:

My Request to ACX/Audible

“I note that AL Net Sales (from which royalties are calculated) have been calculated at the exact same net sales per unit for all of my titles. The amounts on my November 2020 report, have remained unchanged for months and years. This is clearly the case for the US store. I assume that the same unchanged net sales amount exists for each non-US Audible market as well. I can’t be sure, because all non-US Market net sales amounts are only reported in US dollars. Exchange rates fluctuate, and Audible provides no further calculation details on the various exchange rates used each month.

I conclude that Audible is not calculating AL royalties in accordance with methodology prescribed in the contract.

I object to Audible not following the prescribed royalty calculation methodology as outlined in Exhibit A of the Audiobook License and Distribution Agreement. Please provide me with detailed calculations for each month to show that you have complied with these contract terms.

I also object to the end result of whatever calculations you are doing to compute the AL royalty amount, which works out to approximately half of your stated royalty rate.

Instead of paying me the stated earned royalty rate of 25% (non-exclusive) or 40% (exclusive), Audible is paying me only half of that, 13% (non-exclusive) or 21% (exclusive).

What specific deductions amount to half of all sales? Please provide details to reconcile how a 40% stated royalty becomes 21%, and how a 25% stated royalty becomes 13%.”

ACX/Audible’s Response

(Lines bolded by me for emphasis)

I also understand that you have some questions about the Allocation Factor. Audible members pay a fixed price for credits, so we use the Allocation Factor to weight royalty payments for member credit sales based on an audiobook’s list price. This allows us to share the revenue generated by members in a fair manner. Historically, this has meant that the royalty payment for a member sale tends to be about one-half of the royalty payment for cash a la carte sales to non-members. The inputs of the Allocation Factor are proprietary information, so I can’t share those numbers, but I can share that at this time we are applying a floor for ACX providers. This floor protects ACX providers’ from downward variation, boosting their royalty streams in the event that the calculation of the Allocation Factor is below the floor.

ACX/Audible, Oversharing with Itself

At least ACX actually replied to this latest email of mine. Most of my emails, and emails from many author colleagues, simply go unanswered. (ACX, you must know by now that we are not going away without answers). These answers leave me with even more questions…

First of all, ACX/Audible, you seem to be sharing a little too much revenue with yourself? And not in a fair manner? Saying that you are boosting ACX providers’ “royalty” streams is laughable to me and other authors and rights holders. I would ALAF out loud if this didn’t so dramatically impact my continued ability to earn a living.

- What, exactly, is causing this “downward variation” you describe?

- What is this “floor” you speak of? This so-called “floor” is most definitely NOT in the Audiobook License and Distribution Agreement. ACX/Audible, I never agreed to any “floor”. IT’S NOT IN THE CONTRACT.

- The inputs of the Allocation Factor are not proprietary information. The calculation is explicitly stated in the Audiobook License and Distribution Agreement above.

- What do you mean by “the revenue generated by members?” Rights Holders’ audiobooks are the products generating revenue for you.

- One final question: Who, exactly, are you protecting us poor little ACX providers from?

I think I know the answer and it’s not the big bad wolf. But there’s more to this horror tale…

ACX Answers Keep Changing

Another author asked the same questions I did, but got a slightly different answer:

ACX/Audible’s Response:

For credit sales, aka ‘al' sales, the formula is ‘ALC PRICE' x ‘AL FACTOR' x ‘QUANTITY' x ‘ROYALTY RATE' = ‘ROYALTY EARNED'.

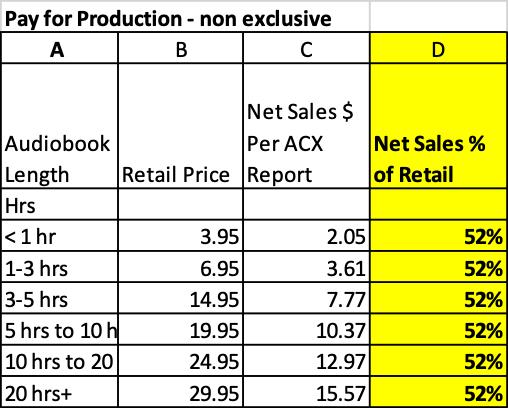

The AL FACTOR is 0.52.

For cash sales, i.e. ALOP and ALC, the formula is [‘ALC PRICE' minus ‘Discounts'] x ‘ROYALTY RATE' = ‘ROYALTY EARNED'.

Wait, what???? The AL Factor is 0.52?

- What about the complicated royalty calculation formulas in the contract? How can it always be 0.52?

Now that you’ve told us that proprietary information, I’ve got a few more questions for you, ACX/Audible.

- How is this mysterious 0.52 derived? According to the contract terms above, it’s essentially a proration of earnings of all audiobooks in the store, dependent upon the number of memberships in that month. In other words, a constantly fluctuating number that shouldn’t be 0.52 for months and years on end.

- Did you forget to recalculate each month like they are supposed to?

- Or did you decide to just make 0.52 “the floor”?

Well, I am floored that you seem to be making up new calculations that are not part of the stated contract terms.

Some Conclusions

From my deductions, it appears that ACX/Audible thinks that contract terms apply only to us, leaving them free to do whatever they want and keep almost all of the profits.

Remember from my first blog post, when Audible promises to pay you 25% royalties for non-exclusive titles, they really only pay you 13%. We’re going to dig a little deeper so I’m including the table again here. If you distribute to other retailers (non-exclusive) you get this:

The Mystery of the Floor

Back to this mysterious “floor” number that seems to have come out of nowhere. It’s not in our contracts. Yet in the author email above, ACX Support tells an author that the so-called “floor” is 0.52.

Guess what else equals 0.52?

Net Sales is 52% of the Retail List Price:

Net Sales and Double Deductions

Audible has only recently revealed the existence of a “floor” number. They claim this “floor” is to stop further downward variation. And who, pray tell, is causing this mysterious downward variation but ACX/Audible itself.

If you scroll back up to the contract excerpts noted at the beginning of this post, it’s pretty obvious that those complicated formulas aren’t being used. As I said before, it’s impossible to get a constant 52% output from those calculations.

The contract excerpt above basically says this:

Sales receipts

less any cash incentives, promotional discounts, device subsidies or rebates, sales or use taxes, excise taxes, value-added taxes, duties and returns

(Deduct these selling expenses to get)

Net Sales

And yet we know that:

- Returns don't go into in a pool. They are directly clawed back from author instead.

- Promotional discounts don’t go into a pool. When Audible sells our $29.95 book for $5, that discount is directly deducted from us. We get 13% of $5, not 13% of $29.95

And yet, by any industry standards, ACX/Audible has massive selling expense deductions equating to 48% of gross sales. That’s before even deducting off other costs, like the goods sold and overhead costs.

Companies with astronomical selling expenses can’t sell very well. In other words, they are so poorly run that they are probably on the road to bankruptcy. It’s not economically viable to have 48% selling expenses before deducting your other costs. However, ACX/Audible seems to be thriving.

- Are those deductions and net sales numbers legitimate?

- Or is ACX/Audible getting an unearned windfall by deducting returns, discounts etc. from Rights Holders twice?

My deduction is that this could be the case.

My Conclusion

ACX/Audible is not following its stated contract terms. They are not paying the royalty amounts prescribed in the contract. They aren’t doing any sort of pool accounting. Their “floor” number is something they made up (perhaps when they realized we had proof that they were not following the prescribed royalty calculations?)

Did they not like the numbers that resulted from the royalty calculation formula that they themselves made up? Or did they not bother to use it?

It appears that ACX/Audible has skimmed an easy 48% off the top for all these years, with zero explanation. Their contract terms combined with our earnings statements imply that we are being deducted twice for returns and promotional discounts.

We can only go on the sparse information they provide us, but that is what they have told us says, if we are to believe both the contracts and the earnings reports.

ACX/Audible still refuse to answer our questions in any meaningful way.

Rights Holders need more answers and Audiobook Creation Exchange (ACX) can’t continue to operate as a one-way cash stream to Audible with only the crumbs left for us, the creators of the audiobooks that millions of Audible listeners enjoy.

What You Can Do

- QUERY: Write to [email protected] with this information in hand and ask them to explain why your payment statements are so far removed from the contract you signed.

- SHARE: Share this #Audiblegate post with other audiobook rights holders and follow #Audiblegate social media: Facebook here and Twitter here.

- VISIT: #Audiblegate.com here

- READ: #Audiblegate Blog Posts here

- PETITION: Sign the #Audiblegate petition here

- MAILING LIST: The #Audiblegate mailing list is here. Sign up to be kept updated as this important campaign develops.

Ms Cross…That was an sizeable bit of forensic accounting that you did and it is most appreciated. You are to be commended if not remunerated (if at all possible ?) for this endeavor. It does point out the the incredible lengths and machinations that a monopoly goes to justify themselves and to garner all the profits without the risk. Tis sad.

I put nine books on Audible/ACX this year, all exclusive, all production costs paid upfront. I’m totally confused each month when I get my report. Math isn’t my “thing,” but I do know how to calculate 40% of a given number. Nothing makes sense with Audible’s hokey math.

Thank you for this article. It confirms I’m not crazy and there’s really something wrong with the lack of transparency and bogus calculations with our earnings reports. It’s disheartening.

Thank you for all the work you’ve put in. I was fairly sure that I would be shunning Audible despite their position in the market before, now I know I’ll be doing that and telling my readers why. Instead I’ll be offering my audio book on my own website for a much lower price than I would have to charge through Audible and keeping over 90% of the proceeds. I may not sell nearly as many or get the exposure I could through Audible, but I’m not willing to get robbed by another Amazon company.

Thank you again.

Your diligence and attention to detail on this is very much appreciated, Colleen. Thank you.

Thank you! Oh, and not to mention that I received an email from them stating authors are paid FULL PRICE ROYALTY when they sell my books ‘on sale’ or at a ‘reduced price’ because I wrote to them complaining at them selling some of mine continually on sale … I have that email saved … and replied stating that is not the case. However, of course, they have not replied to me on this matter! I have also emailed about this mysterious 0.52 … and, again, have received no reply. Funny that … isn’ t it? ACX/Audible are up to no good and need to be held to account for what they are doing!

Thank you, Colleen, for all that you are doing!!!