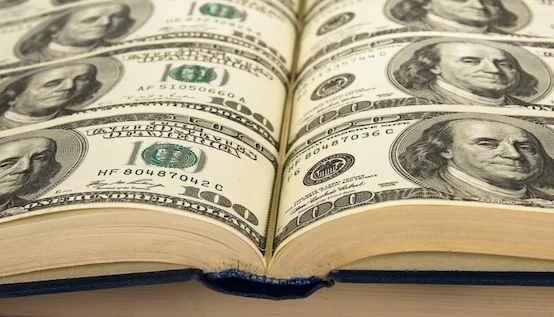

Karen Myers shares her expertise in financial management for the benefit of indie authorpreneurs

To help indie authors evaluate the effectiveness of their writing as a business, in a new short series of posts US authorpreneur Karen Myers, formerly a Chief Operating Officer and Chief Financial Officer for several small-medium businesses, tells us how to evaluate our writing activities commercially and how to improve their profitability.

In this first post, she defines the concept of our gross income, shows how to calculate it, and demonstrates strategic use of that information.

(Karen uses accounting terminology from the USA business world, but all countries do similar things though the terms may vary.)

To evaluate our writing in business terms, we need to look upon our activity as authors and publishers just as if we were a small factory.

What that means is being able to ask questions like these:

- Is our business model sound?

- Is it improving over time?

- Is it covering all of our costs, including those not specific to individual titles?

- Are we actually making a profit, and how long should we expect that to take, after starting the business?

It's not just a matter of counting our sales at the end of the year.

What's the point of financial analysis?

An income statement isn't just a tedious document that old-style businesses put together — when done right, it's vital and important information to help you direct your spending and efforts.

I'll focus on three ways to look at our businesses, and the data we need to support that. In this post, we'll consider gross income; net income and ROI (return on investment) will be examined in future posts.

Gross income — your business model

When we start as indie authors, we generally focus on the creation of work to publish (I'll call that “books” or “titles”, whatever you may be writing), and the delivery of that work to distribution and retail publishing channels.

Over time, many of us develop additional ways to earn income. As an example, I have the following channels today, in various stages of maturity:

- Creation and sale of 24 titles (my own books)

- Publication of titles for others (publishing work, several imprints)

- Consulting work for colleagues

- Speaking engagements

Each of these is a “line of business”, with its own costs and income.

Some are relatively predictable while others are not, but all can be grown by marketing, if that seems like a worthwhile investment.

For each of these lines of business, I have income and direct cost. The direct cost is specific to each business line and an element in that business line (eg paying for a cover for a particular title, or hours spent on a particular consulting gig), not a general or indirect cost like office supplies or internet access. The typical term for that direct cost in the US is “Cost of Goods Sold”, or “COGS”.

The reason you consider each of these channels separately is that they behave differently. You could lump them all together and call it “income” and “COGS”, but you wouldn't learn anything by that. For example, I could lump together the first two bullets — it's all publishing — but my own works have a different cost structure since they include the significant investment of my labor hours to produce the manuscript. If I were doing subscriptions for podcasts, that would look very different from simple “speaking engagements” as a business line.

Keep your lines of business separate and unique whenever they have structural differences in the way they make money or require money.

What about labor costs?

In a larger business, we would pay salaries,and that includes paying for our own labor. Until we reach that size (if ever), we should track our labor for the direct costs of our business lines, just as any factory would have a time clock for the people who produce the goods.

Why? Our time has value. In principle, we could be earning a salary somewhere else. It's an illusion to think that our time doesn't count when we look at the costs and income of our titles, since the time we spend writing is by far the largest cost associated with our books. It takes quite a bit of investment in, say, audiobooks or translations, before you exceed your labor cost (your hours x a realistic rate).

(For our small informal businesses, there's no way to show our labor cost – we don't have salaries – but when we analyze Return on Investment (ROI) in a future post, that will come into play.)

Gross Income = Income (for each line of business) minus COGS (for each line of business).

This is your Business Model. This is the engine of your business, how you make money.

It might not be profitable from the start (it takes a little while to earn enough to offset the direct costs), but it should be profitable in principle as soon as enough time passes (the initial costs stabilize, and new income arrives). When you look at these numbers, you should be able to see your way to profitability over time, even if you're uncertain about how long that time will take.

If you can't see how it can ever be profitable, then you have a problem. Either your costs are too high (spending too much on editors, covers, etc.) or your sales are too low (need marketing, better appeal, etc.), or both.

At the beginning, you should wait until you have several products before despairing, but it is still important to keep an eye on it. It's a cliché that a typical startup (in any industry) takes five years or more to achieve profitability.

We're lucky that in our industry the start-up costs are so small we don't normally require outside investment (other than our labor) to carry us over this period until we are profitable.

If your business model doesn't look like it can be profitable in principle eventually, then you haven't got a business.

Companies experiment with new lines of business all the time — it may well be that you have mature business lines that are profitable while others are immature and uncertain. That's another reason you want to set things up to track each line of business independently, so that you can make judgments at the line of business level about investing more effort or cutting the experiment off if it doesn't look like it can ever be profitable.

Coming soon: two further posts will address Net Income and Return on Investment.

Karen Myers frequently shares valuable business management information relevant to indie authors on her website, www.hollowlands.com, as well as news about her writing and publishing activities, such as a longer version of this post here.

#Indieauthors - do you know how to work out your gross income and how to use that data to improve your author business? Let @hollowlandsbook authorpreneur Karen Myers explain... Share on XOTHER VALUABLE POSTS ABOUT FINANCIAL MANAGEMENT FOR INDIE AUTHORS

From the ALLi Author Advice Center Archive