Today, the Alliance of Independent Authors #AskALLi team look at the facts and figures about self-publishing and the impact of indie authors on the wider publishing industry. Special thanks to Authorearnings.com, Pew Research, FicShelf, Neilsen, PublishDrive, Alex at K-Lytics, and especially Mark Williams Director of International Communications at StreetLib and Editor-in-Chief, The New Publishing Standard (TNPS), who today joins the ALLi blog team, and will provide us with a weekly global update “International Insights for Indie Authors” here on the Self-Publishing Advice Blog.

Facts and Figures about Self Publishing: An Introduction

Facts and Figures about Self Publishing: An Introduction

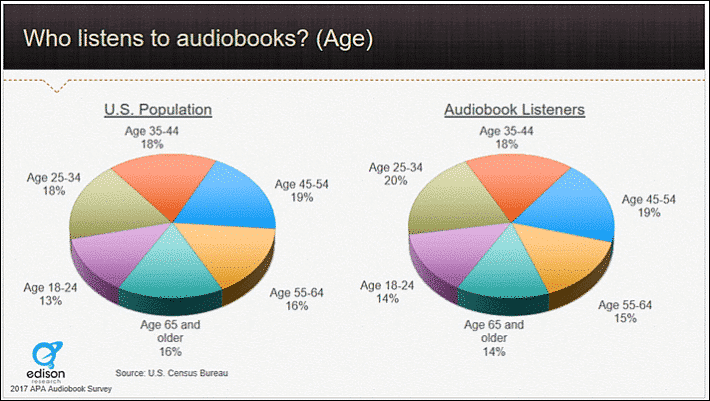

It's mind-boggling that just 15 years ago, there were no iPhones, no Kindles and barely an inkling of the impending self-publishing revolution. In a few short years, indie authors have irrevocably changed the industry: now accounting for 30-34% of all e-book sales in the largest English-language markets, depending on which source you read (and none of them tell the full story), and making real inroads into the audiobook market too, and into print, through print-on-demand.

The book industry is a huge, influential and reliable global consumer market. In 2018, the most recent year for which full figures are available, 675 million print books were sold in the US, 190.9m print books in the UK, and is valued at $312m and NZ$1.8 million in Australia and New Zealand, respectively. The new digital formats of e-books and audiobooks generate billions in global revenue each year.

These are the figures reported from the “official” book trade but there are a wealth of sales outside these. Trade publishing is a relatively structured and orderly sector, in which supply and demand operate within scarcity economics. The self-publishing sector, by contrast, is a beautiful, bubbling, chaos, typified by abundance and diversity, driven by authors, other creatives, publishing entrepreneurs, and business people from all sorts of backgrounds and approaches, bringing together the most forward-thinking creative minds in an environment where they can freely create.

Much of it is not documented… or only in a haphazard way. There's something of a black hole in our industry—a gaping void that other industries have ample data to fill. Amazon and the other self-publishing platforms don't release data about their book sales, and don't break those sales down into trade-published and author-published books. Self-publishing sales figures are higher than anyone knows, or can know, as many self-published books sell without an ISBN, through author websites, in special consignments, at weekend markets, back of the room events, and many other ways that go unrecorded.

We know self-publishing is having an enormous impact on the publishing industry, we feel it in our creative souls. Aside from our “feels”, what do we know? Where is the evidence? What's selling where? And how do indie authors use what is known to grow their sales?

Below are some of the statistics we've been able to glean but we'd like to get a clearer picture. To do that we're wondering: what would you most like to know about the self-publishing sector? What information would be most useful to you? Answers please in the comment box below.

A Brief History of the Self-Publishing Industry

Summer reading. Picture by Perfecto Capucine on Unsplash.

The publishing industry is old. According to Wikipedia, by 1501, over eight million books had been printed. the book industry changed remarkably little between then and the end of the last millennium, when the computing revolution changed authors' lives in ways that nobody envisaged at first, ushering in the self-publishing revolution.

With the advent of digital technology and smartphones as reading devices, circa June 2007, those creatives frustrated with gatekeepers suddenly saw an opportunity. Shortly afterward, in November 2007, the Kindle was born, integrated with the largest online bookstore in the world, and the stunning self-publishing innovation of Kindle Direct Publishing (KDP).

By 2011, self-publishing and the rise of e-books was in full swing. Many books dismissed as “slush” by corporate publishers went on to be beautiful, much loved, highly successful, author-published books.

Two short years, 2011-2013 saw a Kindle gold rush, a period where self-publishers could put a book on Amazon and with very little advertising make a considerable profit, benefiting from the organic visibility. (By 2012, Amazon had invented their AMS ads platform and over time that organic visibility started to dwindle, replaced with the need to pay for the same level of traffic and visibility through their advertising platform.)

KDP shares the e-book self-publishing sector with other global players that have deep pockets—Apple, Barnes & Noble (Nook), Google, IngramSpark, and Kobo (with funds from Japanese Rakuten). But it was Amazon that kickstarted the indie author revolution, bringing KDP to authors and the Kindle to readers, and is the largest player in the book business today–by a country mile. This menas there is most commentator interest in their platform, and we have more information about them than any of the others.

There are indications that this may be changing a little, with an increasing number of authors are now publishing widely across a variety of platforms, formats and territories. Self-publishing platforms today take indie authors and their books to 190 countries.

Taken altogether, indie author sales continue to increase globally at a rate which is, in the word of veteran publishing commentator, Mike Shatzkin, “staggering”. In his latest publication, The Book Business: What Everyone Needs to Know (2019), he points out that between 2011 and 2013, the non-traditional share expanded rapidly from nearly 0% to almost 30% of the book units sold in the US… even as the overall size of the e-book market itself was growing rapidly.

By 2014, within five years of mainstream digital self-publishing becoming widely accessible, it was accounting for more than 30% of all recorded book-sales in the US. Almost 300m self-published units generated 1.25 billion in sales in 2016, in the US, in a $6billion industry.

Facts and Figures about Self Publishing: The Industry Today

Today, says Shatzkin, “hundreds of thousands of book buyers spend real money to buy and read untold pages of books written and uploaded into the cultural bloodstream with no judgement, mediation, review, or pitching by the traditional keepers of the gate.” If we look beyond the US, which is the territory that Shatzkin and so many commentators analyze, that becomes millions. There’s far more to the global book market than Amazon, which reaches just a fraction of the global book market, as we shall see below.

The emergence of smart devices, e-books, and online subscription models has transformed both the publishing landscape as well as the reading behavior of readers. Some of the popular e-commerce vendors that offer e-books include eBay, Walmart, and the Alibaba Group, as well as Apple Books, Google Play, and Kobo.

- Amazon’s Kindle Unlimited paid out over a quarter of a billion dollars to indie authors in 2019, apart from regular sales.

- One in every four books that sells on Kobo comes from their self-publishing platform, Kobo Writing Life.

- Kindle Unlimited (KU), Amazon’s ebook subscription program, is estimated to represent about 14% of all ebook reads in the Amazon ecosystem, according to Author Earnings and 85 percent of these are produced by self-published authors, plus 2,000 audiobooks from Amazon’s Audible business.

KU’s biggest US competitor is Scribd which offers 500,000 books at time of writing, with a major content contribution from self-publishers plus books from nearly 1,000 publishers including HarperCollins, Simon & Schuster and others.

Diversity in literature is also—and about time—facing its own explosion. In an article, TCK Publishing explain that back in 2011, Malinda Lo and Cindy Pon ignited a movement (#WeNeedDiverseBooks and #DiversityinYA) through a conversation on twitter…

“who wondered why people thought they wouldn’t enjoy their YA fantasy books just because they were in fantasy Asian settings.”

TCK Publishing continue to say that “The problem of a lack of broad representation of different people in fiction has been recognized since at least 1965.” Back then, only 6.7% of children's books had included black characters. While there have been big strides in recent years, in 2013, “the numbers weren’t much better: only 10% of children’s books included people of color, even though a full 37% of the United States—and most of the rest of the world!—wasn’t white.”

There are anecdotal reports of how self-publishing is diversifying the book-world, and it seems likely, but research is needed as are more own-voice authors and diverse characters across fiction.

We do know that there is a gender split in self-publishing that is a mirror opposite to the publishing trade. A study by FicShelf found that 67 percent of top-ranking self-published titles were written by women, versus only 39 percent of the top traditionally published titles. Trade publishing favors male authors, but with self-publishing, women are able to build success for themselves.

Facts and Figures about Self Publishing: Indie Author Earns More and More Reliably

Facts and Figures about Self Publishing: A Global Industry

Global. Picture by Kyle Glenn on Unsplash.

“Today there are just shy 4.7 billion people online, many in places you’d least expect” says Mark Williams, Editor in Chief of TPNS. “The USA is not the biggest. In fact, it comes in at only third place, behind China (854 million internet users) and India with 560 million people online. The USA has 312 million online and no room to grow.

Germany and the UK next, right? Don’t you believe it. Next comes Indonesia with 171 million online, then Brazil (149m) and Nigeria (126m). Before we get to Germany we have to pass Japan and Russia. Oh, and Bangladesh (98m online) and Mexico (88 million online).

Only then comes Germany, with 79 million online, and that by a tiny fraction over the Philippines, which will overtake Germany this year. Then comes Turkey (69m), Vietnam (68m), and Iran (67m) before we get to the UK with just 63 million online. France with 60 million internet users is just ahead of Thailand (57m), which in turn is ahead of Italy (54m). Egypt rounds off the Top 20 with 49 million internet users.

Across the Arab markets of North Africa and Middle East, there are 220 million people online. And there are more surprises out there in the big wide online publishing world.

- Canada has 33 million internet users. Kenya has 46 million.

- Australia has 21 million people online. Tanzania, South Africa, Morocco, Algeria and the Kingdom of Saudi Arabia all have more.

- Africa had 4.5 million people online as this century began. Today, in 2020, that has grown to 526 million people.

Africa has more people online than the USA and Canada, together, all of North America. More than Latin America. More than the European Union.

“But does anyone read in these places?” asks Williams. “Well, since you ask: The world’s biggest book fair is in Egypt. 3.5 million people attended this year. The Algeria, Iran, Sharjah (UAE) and Kolkata (India) International Book Fairs each attracted over 2 million visitors in 2019. The Riyadh (Saudi Arabia), Baghdad (Iraq), Buenos Aries (Argentina), Bangkok (Thailand), Havana (Cuba), Colombo (Sri Lanka), New Delhi (India), Muscat (Oman), Hyderabad (India) and numerous other international book fairs each attracted over 1 million visitors in 2019. The list of book fairs that “only “ attracted upwards of half a million is too long to even begin listing – Bogota (Colombia), Lima (Peru,) Casablanca (Morocco), etc, etc, etc.”

Headline from TNPS confirm that this interest translates into cash spent

- Publishers laugh all the way to the bank” as India’s Chennai Book Fair sees 1.3 million visitors spent $2.8 million on books (January 2020).

- India’s Madurai Book Fair expects 300,000 visitors to buy 1.5 million books. Just another quiet India book fair (August 2019)

- Peru’s Lima International Book Fair targets 590,000 visitors and $6 million in sales this year. (April 2019)

Other recent facts and figures from TNPS attest to the vibrancy, diversity and potential of the global book market.

- TikTok owner ByteDance moves into the 560 million listener $1.1 bn China audiobook arena with AI narrations

- Penguin Random House India opens an exclusive ebook store – on Amazon– to reach India's 500m+ internet users

- Netflix Nigeria to adapt classic African literature for TV streaming. Can publishers rise to the opportunity?

- Sweden’s Nextory sees 94% revenue and 110% subscriber growth in Q1, collecting $6 million in new funding for European expansion amid “fantastic growth” in audiobook and ebook subscription. Norstedts Förlagsgrupp sees digital revenues up 41% in 2019, with 50% from digital and 25% from audio and Bookbeat’s new data-sharing tool is a watershed moment for subscription publishing

- Storytel sees subscribers grow 38%, streaming revenue 45% and raises $96.5 million in new funding. This is a vote of confidence in the unlimited subscription model, not just the company

- Denmark’s podcast start-up Podimo raises $16.8 million for expansion

- Kobo Plus subscription service prepares launches in France and Canada

- Bologna Children’s Book Fair doubles its audience by going online at last minute.

- Germany’s Bookwire grew sales by 35% in 2019. 140% growth in audio; ebooks up 24%

- Mexico book market plummets 88.2% amid pandemic. Mexican publishing reinvents itself digitally to save the day

- Iran sees 4-fold increase in ebook and audiobook downloads during coronavirus lockdown

With thanks to Mark Williams, Editor-in-chief of The New Publishing Standard, for his valued insights and research for this section.

Though readers are global and can buy online, regionally there are very different market developments in all publishing formats. Asia is not a single market, the mature Japanese market for print is declining, while markets in China and other low-cost countries are growing. In print especially, the picture varies between countries (see below).

Facts and Figures about Self Publishing: Audiobooks

Facts and Figures about Self Publishing: Audiobooks

Facts and Figures about Self Publishing: Print

The global book printing market is anticipated to reach values of around $49 billion by 2024, growing at a CAGR (compound annual growth rate) of more than 1% during 2018-2024, according to Report Buyer's book printing report. Within that global print sales market, self-publishing is the fastest-growing segment, with a CAGR of approximately 17% during the forecast period.

According to Bowker records, Amazon’s market share of self-published print books in the US increased from 6% in 2007 to 92% as of 2018. During the same period, vanity press publishers dropped their share from 73% of all books published in 2007 to just 6%. Today, it is just 1%. The better options available to authors are making a difference. The turning point came between 2011 and 2012 when Amazon “absolutely crushed their competitors” says self-publishing service Author Imprints.

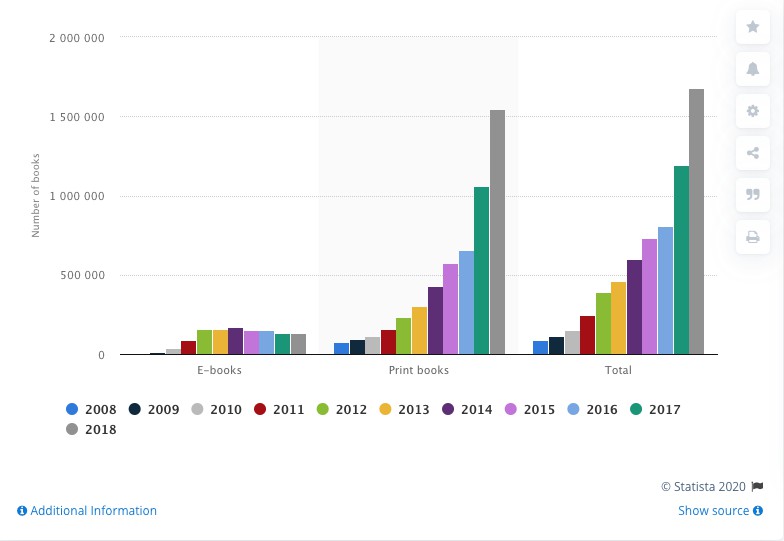

A report by Statista says over 675 million print books were sold in 2018 in the US alone. They say:

“Whilst it is common knowledge that traditional media is no longer as prosperous as it once was, and print newspapers and magazines in particular are suffering, data showing how many books were sold in 2019 revealed that the printed book market is surprisingly healthy.”

While ebook and audiobook sales are climbing, print is still the most popular format in the US, according to Statista,

“Data shows that the book consumption penetration rate in the United States has fluctuated continually since 2011, with audiobooks growing in popularity whilst print book readership has waned. However, print books remain the most popular book format. In 2019, 65 percent of survey respondents stated they had read at least one print book in the past year, forty percent more than the share of adults who had read an e-book in the same period.”

The global printing industry is forecast to reach $821 billion by 2022, driven by digital and POD printing, according to a new market report by Smithers. Digital's share of the market will increase in value terms from 15.7% in 2017 to 19.3% by 2022, as the next generation of presses improve productivity and quality. There is a disconnect between regions with highly developed print sectors – North America, Western Europe, Australasia, Japan, South Korea, Singapore and Taiwan – and other Asian countries, Latin America, Eastern Europe, the Middle East and Africa, where print markets are less developed.

The leader in the print POD sector–Ingram–

Facts and Figures about Self Publishing: Indie Authors Selling Rights

Deal. Picture by Cytonn Photography on Unsplash.

Just like the ability to publish, the rights markets are slowing opening up to indies too. ALLi recently ran a six-month program with the aim of opening up the rights market to self-published authors, you can read more about that here.

The Coronavirus Pandemic

The pandemic and lockdown put physical bookselling on hold, so that trade publishing shifted its focus online and became more digital-focussed. Though this prompted a huge movement from the indie bookstore-supporting community who created the “Save Indie Bookstores” movement in an effort to stop the permanent closure of bookstores as a result of coronavirus. The movement saw enormous donations from the likes of James Patterson and Rick Riordan pledging a whopping $100,000. Many more industry titans like Veronica Roth, Michael Connelly, Penguin Random House and the Hachette Book Group to name a few pledged between $10,000 and $99,000.

Piracy is a problem, globally. In 2012, the Russian government released official statistics that at least 90 percent of available Russian ebooks come from pirates.

What Do These Facts and Figures about Self Publishing Mean for Indie Authors?

Future Research: We Need Your Input

Over at ALLi, we want to commission a research study to look at filling the data-hole in the self-publishing industry. That's where you come in. We don't want to just commission a research report, we want it to be useful for our members. We want it to cover the areas and topics you're most interested in finding out more about.

So tell us, where do you feel data is needed most? What would you like to see in a data report about self-publishing?

I got here looking for information on WHY people self-publish, as it is very common these days to do it in response to requests, or to elevate yourself as a thought leader, or as a marketing move rather than a pure storytelling, passion project.

There’s urgent need for research on the pitfalls to avoided by the indie publishing newbies. Also analyse the industry on genre basis with particular focus on academic reference books

Great article! Very informative.

I see a request for break down by genre, which would be good. It would also be useful to have data broken into vanity press, POD like Amazon and independent publishing. But I appreciate this may be hard to discern.

What I think would be really useful is some information for upcoming and established indie authors who would like to enter eastern markets. Things like culture, translations and trends, that could open new opportunities for writers in the west.

Hi Snyman! That’s what we cover on Saturday’s in Mark William’s International Insights column. Check it out: https://selfpublishingadvice.org/category/international-insights/

This is an interesting article, and paints a rosy picture about self-published authors. A few do earn enough to make a living, and fewer have hit the jackpot, but there was no mention of the sleazy side of self-publishing, the predators who like to target new and aspiring authors who are seeking guidance from a so-called professional who doesn’t even have the qualifications to guide a piece of tissue from a toilet roll. While the annual numbers numbers of self-published books sold per runs into the millions, certain companies are making tens of millions of dollars a month at the expense of Indie authors who rarely get a penny. And most don’t even know it. It would be an eye-opener for an author to go to one of the Indian book fairs to discover their book was one of the top selling books.

Piracy is is probably the biggest business in the US, followed by the 200 plus media promotion and marketing companies that call constantly (I receive 2 or 3 calls a day, and so far, 59 emails this month).

An average Indie author will be lucky to make $40 to $60 a quarter from the sales of their books, and many suppress the sales of a book because they make far more money off it when they’re not selling. As I say, piracy works. But there are some genuine eBook platforms who do help their authors, Like Smashwords, for example. But they are few and far between.

I am sorry to be so negative, but eleven years down the road and seeing what I have, and been taken to the cleaners for $28, 000 plus, things are not going to change. The multi-billion dollar companies will never pay for the consequences of their actions. One has had a lawsuit brought against them 3 times, and got away with it twice, but continue to scam and steal from the authors – even as much as getting the authors to pay for advertising on their books that they are pirating.

And this is why it is hard to get data on Indie sales.

The article is directed towards those who are careful entrepreneurs and authors. Alli keeps a list of services to avoid and has always argued against vanity presses.

I’d like to see the self-publishing market broken down into genre, and in particular I am interested in children’s books

Need more data on marketing strategies. What works? What does not work? What is typical ROI on advertising? This needs to be explored not just generally but by category.